ATTRACTING INVESTORS WITH SEA AND AFFILIATE MARKETING FOR KOMMUNALKREDIT INVEST

Attracting investors to a new brand in a prolonged period of low interest rates is not easy. Add to this the challenge of meeting deposit volume targets with precision and limited cost per new customer, and the task becomes truly exciting.

After entering the market in Austria and Germany at the end of 2017, the task since then has been to generate deposit volumes to refinance infrastructure projects. A lot doesn't always help a lot - the challenge is to take into account the current financing needs and the desired investment horizon when organising the measures, even if there is little background noise in the meantime.

So how do you collect online deposits as quickly and efficiently as possible - and with changing volume targets and market conditions?

LISTEN AND LEARN

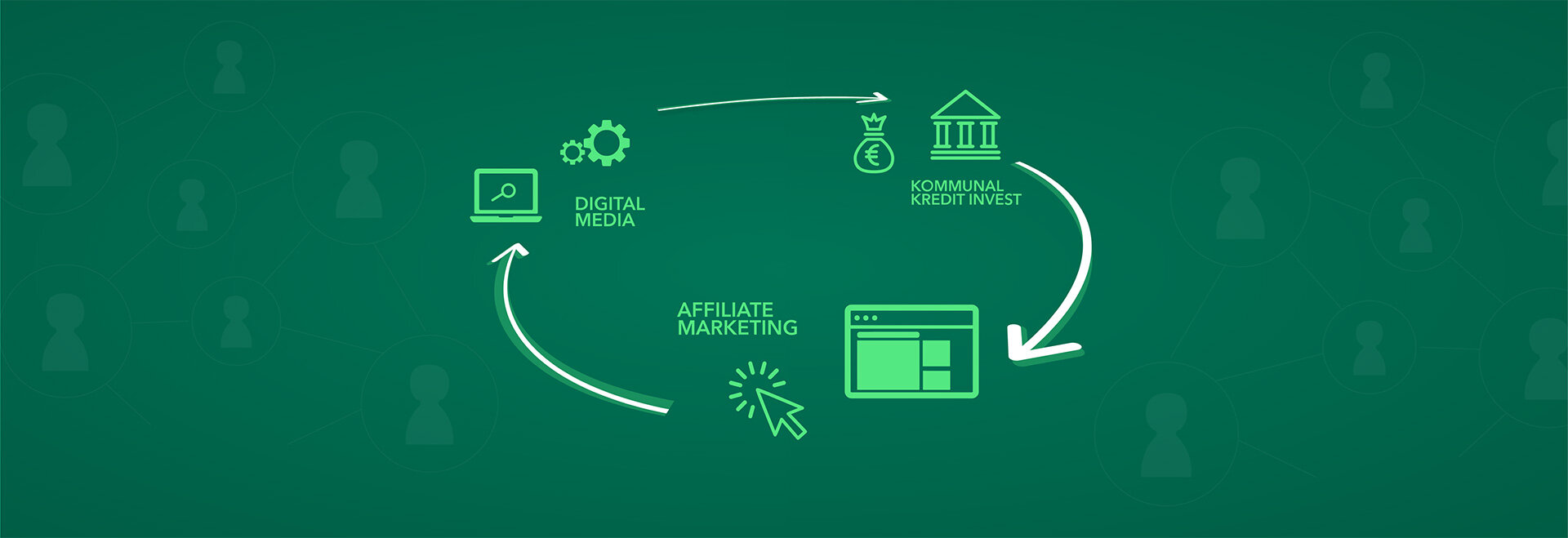

In order to achieve our marketing goals and meet the ongoing demand from investors, we rely on two ongoing performance measures in the lower sales funnel: SEA and affiliate marketing via FinanceQuality. In addition, marketing is selectively supported by prospecting measures in display and programmatic advertising in the event of increased demand for deposit volumes.

The use of multi-channel conversion tracking in conjunction with first-party data (i.e. customer data on the volume of deposits achieved per marketing channel and measure) and granular campaign setup and control is critical to achieving marketing success.

The regular, direct contact between campaign manager and client enables a mutual understanding of market mechanisms and user behaviour, and has yielded exciting insights.

COOPERATION IS QUEEN

The insights gained through the close, collaborative relationship with KOMMUNALKREDIT INVEST resulted in finely tuned campaigns with an efficiently utilised budget. The campaign objectives were consistently achieved from the first year onwards.

Consistent placement in the relevant target groups and flexible campaign management not only resulted in the desired number of new customers, but also in the precise achievement of the deposit volumes targeted for the respective periods.

The new customers show stable, medium-term investment behaviour and remain loyal to the bank even when interest rates fall.

Anne Aubrunner, Head of Online Retail & Markets Sales, Kommunalkredit Austria AG | Vienna, January 2021